The digital revolution: Is your business ready?

The digital transformation we are experiencing today can be likened to the Industrial Revolution – the technological developments that now shape the way we interact with the world would once

Home

The digital transformation we are experiencing today can be likened to the Industrial Revolution – the technological developments that now shape the way we interact with the world would once

With many Australian businesses processing most of their transactions via their EFTPOS terminal, it is no surprise that business owners are always looking for ways to reduce their merchant fees

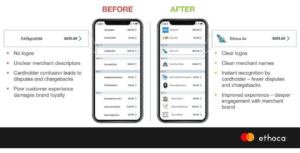

Like most people, you probably know the feeling of checking your debit or credit card statement and seeing an unfamiliar purchase. Maybe it looked vaguely familiar, but the merchant name

The Australia Finance Industry Association (AFIA)’s Code of Practice for the Buy Now Pay Later sector comes into effect on 1 March 2021. The Code is focused on protecting customers

Card or cash? Not anymore. ‘Buy now, pay later’ options have been rapidly embraced by Australians since 2015—completely disrupting the online retail and finance sectors. And with near universal awareness

Least-cost routing functionality helps save on fees because it allows merchants to choose to route a debit card transaction to the lowest cost network for that transaction, which in many

The Reserve Bank reveals the design of the new $100 banknote, which is the final denomination to be redesigned as part of the Next Generation Banknote Program. The banknote will

With as many as 2.1 million Aussie merchants wasting hard-earned revenue by not investigating the best payment service providers, the time is right for a change. As more merchants start

This article is based upon a report originally published by The Initiatives Group in October 2019 which can be read here. A new whitepaper released by The Initiatives Group explores

New research finds one in five small businesses wrongly believe STP doesn’t apply to them In the lead-up to mandatory single touch payroll (STP) reporting from 1 July, global small